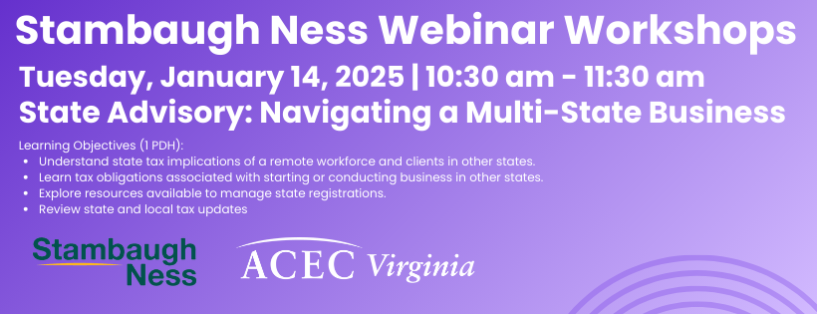

Stambaugh Ness Webinar: State Advisory: Navigating a Multi State Business

Tuesday, January 14, 2025 (10:30 AM - 11:30 AM) (EST)

Description

Session Description:

With 50 states and numerous local jurisdictions, determining tax liabilities can be a daunting task for companies. The complexity further intensifies with each state adopting their own unique tax laws, leaving businesses at risk of non-compliance. Don't let the expanding nature of your business, whether through employees, clients, or both, become a liability. Join State & Local Tax experts Karen Poist and Kimberley Tarnakow for their webinar to gain invaluable insights into your tax responsibilities and learn about resources available to help manage and minimize risk.

Learning Objectives:

- Understand state tax implications of a remote workforce and clients in other states.

- Learn tax obligations associated with starting or conducting business in other states.

- Explore resources available to manage state registrations.

- Review state and local tax updates

Registration:

ACEC Virginia Members: $50

Prospective Members: $125

Only registered attendees will receive the 1 PDH.

Webinar presentation will be given by Karen Poist & Kimberley Tarnakow

Karen Poist, CPA

Karen Poist, CPA

As Managing Director of SN’s State Advisory Practice Area, Karen applies her significant taxation expertise to guide clients through the increasingly complex SALT environment, including tax consulting, compliance, and resolution.

Over her 30+ years working in the accounting industry, Karen has developed a deep working knowledge of corporate taxation, including a specialized focus on state and local sales and use tax, state and local income tax, audit representation, tax planning, consulting, due diligence, and mergers and acquisitions.

Karen enjoys serving clients in a wide range of industries and is passionate about providing clients with solutions that help them achieve their goals.

EDUCATION

- BS degree in Accounting from State University of New York College at Fredonia

PROFESSIONAL & COMMUNITY HIGHLIGHTS

- Alabama Society of Certified Public Accountants, Member, and State Taxation and Legislation Committee Chair

- American Institute of Certified Public Accountants, Member

- Pennsylvania Institute of Certified Public Accountants, State Tax Committee Member

- Recognized as one of Alabama’s Top Talent CPAs, Business Alabama Magazine

ASK KAREN ABOUT

The coincidence that occurred regarding the World Series winners in 2016 and 2018.

Kimberley Tarnakow, CPA

Kimberley Tarnakow, CPA

Kim partners with clients in federal and state tax compliance and consulting, working across many industries and entity types. She spends much of her time focusing on the State Advisory Services area, including income tax implications of multi-state entities, sales and use tax consulting, business licenses, and unclaimed property compliance and reporting. Throughout her career, she has assisted clients in mergers and acquisitions, due diligence, and complex entity structures.

![acecvalarge[1] acecvalarge[1]](https://growthzonecmsprodeastus.azureedge.net/sites/636/2020/03/acecvalarge1-300x232.gif)